Investing Through Superannuation: Practical Strategies for Australians

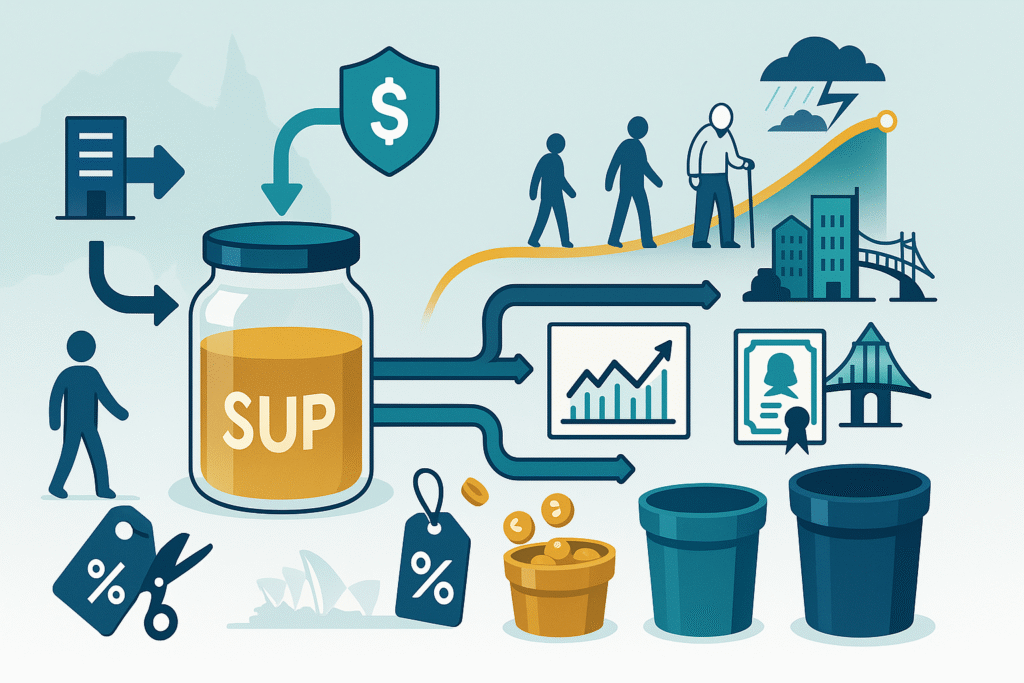

For Australian investors, superannuation is the most powerful tool for retirement funding. It blends legislated contributions, professional portfolio management, and favorable tax rules to create a long-horizon investment engine that compounds quietly in the background.

Money enters the system via the Superannuation Guarantee, with employers paying a set percentage of ordinary time earnings into a complying fund. Members can supplement this with concessional (pre-tax) contributions—often through salary sacrifice—and non-concessional (after-tax) contributions. Limits apply and shift with policy changes, while special provisions such as bring-forward and downsizer contributions can accelerate savings for eligible individuals.

Inside the fund, tax concessions enhance returns. Concessional contributions are typically taxed at a flat concessional rate, and earnings in the accumulation phase are taxed below personal marginal rates. Capital gains on assets held more than a year are generally discounted within the fund. When moving into retirement, transferring an amount within the transfer balance cap to an account-based pension can render future earnings on that portion tax-free and allow tax-free withdrawals for most over 60.

Investment menus span defaults and custom choices. MySuper defaults prioritize simplicity, fee control, and broad diversification. Lifecycle variants automatically reduce risk as retirement nears. Choice options offer targeted exposures: Australian equities for franking credits, global shares for diversification, fixed income for stability, unlisted infrastructure and property for income and inflation linkage, and ESG strategies for values alignment. SMSFs open access to direct assets but add trustee duties: strategy formulation, record-keeping, related-party rules, and annual audit.

Effective super investing demands risk discipline. Sequencing risk is central—drawdowns near or just after retirement can force selling at lows. Many retirees hold a cash ladder or defensive bucket to fund near-term payments while growth assets recover. Rebalancing trims risk and harvests gains. Above all, fees matter: a 0.5% difference in annual costs can translate to tens of thousands of dollars over a working life.

Practical tactics can boost outcomes. Salary sacrifice up to the concessional cap can be tax-efficient. If eligible, claim a deduction for personal contributions to reach caps. Lower-income earners may receive government co-contributions on after-tax amounts. Spouse contributions or contribution splitting can equalize balances, potentially improving access to age-based thresholds and optimizing estate planning. Downsizer contributions let eligible older Australians inject proceeds from selling the family home without using standard caps.

Insurance inside super—life, TPD, and income protection—offers convenience but must be right-sized. Review levels, waiting periods, and exclusions; ensure cover aligns with debts, dependants, and income needs without excessive premium drain.

Retirement turns super from a savings plan into an income strategy. Account-based pensions provide flexibility, investment control, and tax advantages within caps. Minimum drawdowns apply, but retirees can adjust payments to market conditions and spending needs. Some layer annuities for longevity protection and peace of mind, while others maintain higher growth exposure to defend against inflation.

Regulators provide oversight: APRA focuses on fund resilience and outcomes, ASIC on consumer protection and disclosure, and the ATO on taxation and SMSF compliance. Given periodic rule changes, annual check-ins on caps, insurance, investment mix, and fees are prudent.

Superannuation, when engaged with proactively, is a sophisticated investment platform. Harnessing its tax benefits, controlling costs, matching risk to life stage, and using strategic contributions can markedly improve retirement readiness.